The fresh Martingale Approach Forex Method Publication

Articles

Among these boffins, French mathematician Paul Pierre Levy is credited with popularizing the newest martingale program to own successful gambling. Your missing $150 in the 1st five coin flips as you twofold off the stake after every loss. However, on the 5th flip, you obtained and gotten $160, which was sufficient money to recover their $150 losings and also build an excellent $ten money.

Disadvantages And you will Dangers

This is probably as to the reasons Martindale promoted the methods; the guy indeed had the newest gambling enterprise, whatsoever. The dangers much surpass the advantages, and it takes too much wide range to help you weather extended shedding streaks. Development an extensive trading bundle is very important to have successfully using the brand new Martingale approach.

It allows an investor when deciding to take benefit of the effective development by the doubling the condition. If you are exchange on the a great fx program, make an effort to do your homework to understand the fresh money pairs you should change to the, first with quick parcel types. Having said that, the fresh Martingale method is shorter precarious inside the the forex market than just they is actually stock segments. Even though, an excellent currency will get fall-in worth, that is a little evident and unforeseen. But not, this won’t constantly happens that is an example to own an excellent pretty good need. Exchange models deploying a Martingale method is also reach somewhat a significant sum hoping of data recovery.

Martingale Means’s Psychology, Chance Administration and you can Industry Conditions

- Dictate the new advice of one’s development (for example, with the Swinging averages indicator).

- For this reason, the fresh Martingale method might be utilized carefully, and you may buyers which trading on the programs including Quotex should be aware of your risks inside it.

- To start with, it is ideal for staying it as a small % away from your trade account.

- If your stock price provides shedding and you also continue increasing their investment, this may get to the part for which you’ll have absolutely nothing left to install.

The idea is that a winning exchange usually recover all of the past loss and you can trigger money. The new Martingale strategy is an occasion-examined means which involves doubling your position dimensions after each and every loss. The brand new key suggestion about this method should be to get well earlier losings and you can generate an income from the capitalizing on the brand new ultimate victory. As opposed to fixed status sizing, where trading numbers are still lingering, the fresh martingale strategy involves doubling the career proportions dynamically in reaction to market outcomes. The brand new Martingale method is a top-risk currency government approach which involves increasing the positioning size after all of the dropping trading. Even though it can create small-identity development, that isn’t suitable for forex trading as is possible lead so you can significant loss when consecutive dropping positions occur, that is not uncommon in the foreign exchange market.

A good Fx agent is actually a family you to allows people exchange currency out of various countries. Therefore unlike Martingale or something similar, my information is to understand rate action steps and techniques. As well as, if you are going to increase the right position, merely do it if the marketplace is moving in the favor.

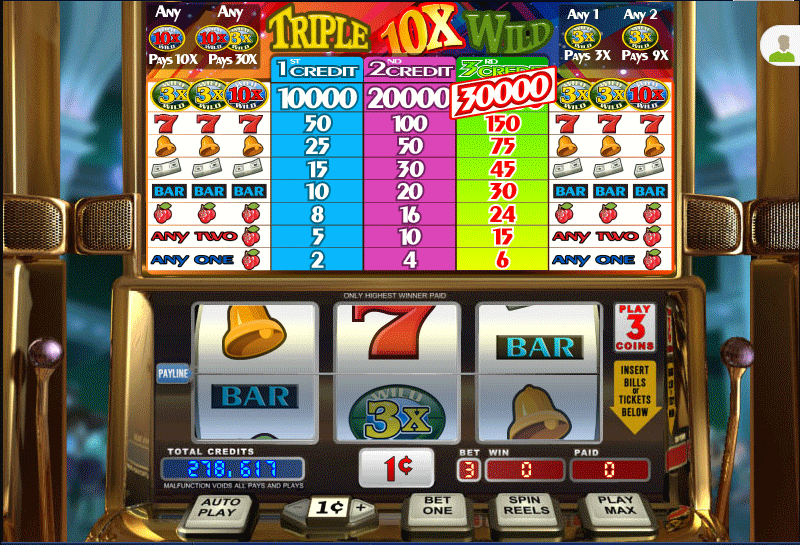

Buy the minimal measurements of their choice (in accordance with the amount of the new https://mrbetlogin.com/butterflies/ put). The new eligibility to own to be a great financed affiliate try contingent on meeting specific performance standards and compliance to your Organization’s analysis techniques. Not all the users usually qualify for funded membership, and earlier performance regarding the simulated environment isn’t a sign away from future success. Four Percent On the web Ltd. (“We”, “Our”, “Us”, or “Company”) operates because the a proprietary exchange corporation. The organization is not a custodian, change, standard bank, exchange platform, fiduciary otherwise insurance policies business outside the purview away from monetary regulatory government.

- The newest Anti-Martingale system has generated-inside elements to possess reducing chance for each trade which means that ultimately cutting the possibility of ruining an investor’s membership.

- It’s more valuable than ever to grasp its advantages and disadvantages to select whether or not they’re also really worth making use of their.

- The brand new Martingale system mostly plans to increase the career in which an investor deals.

Enhance cash recuperation by balancing chance administration and you will using wisely. In the eighteenth 100 years, the new Martingale approach did actually has came from simple money throw game inside the France. It was probably one of the most popular betting tips within the France, and is thought that their identity originated a great French gambling establishment manager or at least a French label for a type of playing behavior. Perhaps you have questioned in case your Martingale method can help you change your trading results on the Quotex? Exactly how legitimate could it be with regards to controlling investment in the digital options exchange, particularly if trade on the Quotex system? Let’s evaluate these issues and discover how to implement this strategy to help you Quotex trade.

At the same time, of numerous brokers features limitation change dimensions constraints, that can end buyers out of continued the brand new Martingale means just after a great particular point. The fresh Martingale Method is designed to help gamblers recover the loss from the increasing its bets after every loss. By doing so, an individual win could easily eliminate previous loss as well as cause a return. This point of your strategy lures those who are lookin to have an instant and you can competitive way to cure a burning streak.

Martingale method success rate (winnings rates)

Fx segments introduce novel pressures for the Martingale means because of the newest built-in power and also the variable results of investments. The technique relies on the fresh investor’s capacity to endure a few losings and still have sufficient money to keep increasing down up until a successful change occurs. The primary difference between this type of tips is the contrary solutions to exposure and money government.

Even though it may seem like a medical method on the surface, the strategy hinges on the assumption you to a new player have unlimited fund and this there are no gambling limitations or table constraints in position. Actually, extremely gambling enterprises demand restrict gambling restrictions, which can easily provide the strategy inadequate. Will you feel there’s a guaranteed means to fix defeat the chances and you can appear on the top regarding gaming? Lots of bettors and you will gamblers the exact same have looked for a method you to definitely guarantees victory in their chosen video game. One particular strategy who’s attained enormous popularity ‘s the Martingale Method. Towards the end, you’ll have a thorough knowledge of that it verified gaming program.

This process is actually examine on the anti-Martingale program, that involves halving a bet when there is a trade loss and you can doubling they whenever there is an increase. Unlike the new anti-Martingale, and that seeks to attenuate risk, the new Martingale method is a risk-trying to form of investing you to definitely betrays an aversion so you can accepting loss. There are some disadvantages when using the Martingale exchange means.

As the chance of multiplying losings and you may quick reduced total of winnings in order to investors try serious. Yet not, when you are determined to use this method, at the least ensure from the chance management. Margin try a hope one agents found away from investors according to how big the brand new account. People must have an enormous enough trading membership to resist consecutive losses.

Such as, you will want to rally a couple of lots of Euros (EUR)/You dollars (USD) from.181 to a single.182 to make sure you do not flunk of the initial trade. Even though MetaTrader and you may cTrader aren’t readily available, Plus500’s very own platform is really associate-friendly. It comes which have various user friendly chance government features and you will can be acquired on the net and you can mobile.

You’ll need to put a minimum of $200 to have Copy Exchange, eToro’s standout element that allows you to definitely follow other people and you will copy the positions. Pepperstone also offers tight develops and you may low commissions, which are beneficial for carrying out a leading-regularity trading approach such as Martingale. The worth of your own portfolio may go off and up and you can aquire straight back less than your invest. Committing to Stocks, Commodities & Currencies may not be right for group. It is very important to help you perform your own examination having a managed and you may leading broker that provides competitive develops.